by

Stacy Wise

| Mar 19, 2021

Written by Andrea Klinedinst, Compliance Assistant and

Mary Smid, Assistant Vice President/Mortgage Underwriter

MNB strives to provide quality products to its customers and communities. The lending department is no exception. They provide a variety of different products and programs to assist in financing your home. One such program is the Downpayment Plus (DPP) program. Mary Smid, Assistant Vice President/Mortgage Underwriter at MNB, had the inside scoop on the DPP program and how to get started.

What is the Downpayment Plus program?

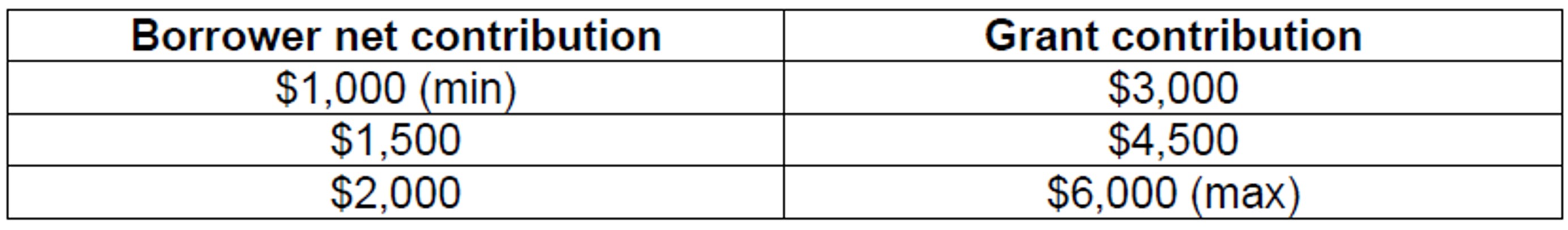

MARY SMID (MS): DPP is a matching program that provides up to $6,000 toward down payment and closing costs for income-eligible homebuyers. The assistance is provided in the form of a forgivable grant paid on behalf of the borrower at loan closing. Grants are forgiven over a five-year retention period.

The amount of funds granted at closing is based on borrower contribution and funds required at closing. DPP is a 3 to 1 matching program. For example:

If the home is sold or refinanced within five years from the original loan date, the borrower may have to repay a pro rata portion of the grant. There are exceptions to repayment which your lender can explain to you.

Who is eligible for DDP?

MS: Borrower eligibility is based on loan purpose and household income:

- DPP is a purchase loan program. Borrowers who are purchasing a home to use as their primary residence are eligible.

- Household income less than or equal to 80% of HUD area median income as published for the current year are eligible. Eligibility will be preliminarily determined at application, and then confirmed per DPP guidelines prior to closing.

Homebuyers must meet income eligibility requirements, and:

- Contribute at least $1,000 to the purchase of the home

- Complete pre-purchase homebuyer education and counseling

- Live in the home as your primary residence

How can you get started with the DPP program today?

MS: Downpayment Plus is only available through participating lenders. MidAmerica National Bank is a participating lender.

MNB is committed to helping our communities. We can help lower your borrowing costs if you qualify.

Prequalify with MNB by applying for a home loan. Click here to apply online, or call one of our mortgage loan officers today!